Retirement Readiness: Breaking Bad Spending Habits Before It’s Too Late

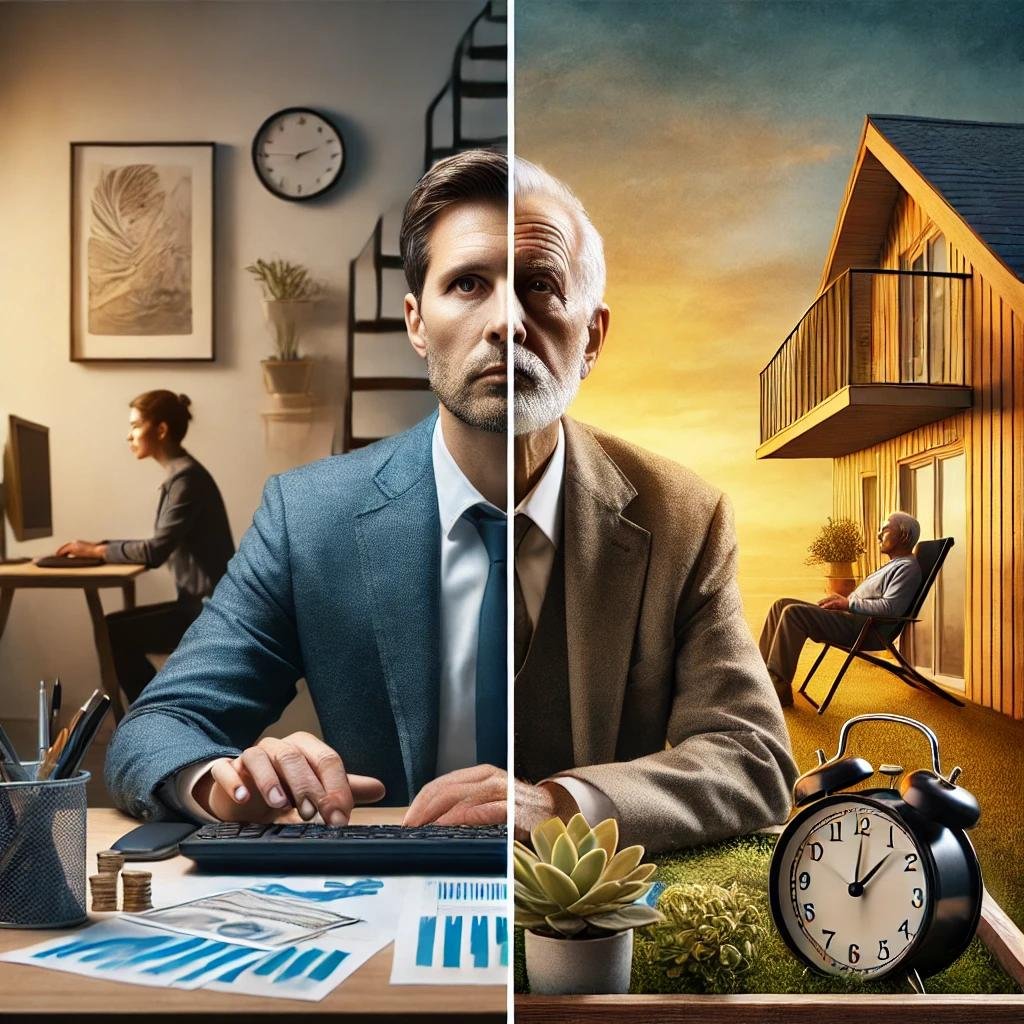

Retirement is often seen as the ultimate goal—the reward for years of hard work and saving. But for many, the transition to retirement comes with unexpected challenges, especially when it comes to managing finances. Bad spending habits developed during working years can have a lasting impact, threatening the very foundation of a secure retirement. In this post, we’ll explore three crucial areas to consider before stepping into retirement: the psychological shift, creating new habits, and warning signs of early retirement.

1. The Psychological Shift: From Earning to Spending

One of the biggest adjustments in retirement is shifting from an income-based mindset to a withdrawal-based one. For decades, you’ve been conditioned to earn and spend, but once that paycheck stops, the spending habits you formed in your working years could become problematic. The psychological shift from accumulating wealth to drawing it down can be difficult to manage, especially if overspending has been a persistent issue.

Key takeaway: To make your retirement funds last, you’ll need to reassess your relationship with money. This involves a mental reset—accepting that the rules of financial engagement have changed. Instead of income coming in regularly, you’ll now be withdrawing from your savings, which makes mindful spending and budget-conscious decisions more critical than ever before.

2. Creating New Habits in Retirement: It’s Never Too Late to Change

Just because you’ve entered retirement doesn’t mean you’re stuck with the financial habits you had before. In fact, retirement can be the perfect time to reinvent your relationship with money. Whether you’ve struggled with impulse buying, lifestyle inflation, or simply not budgeting well, creating new habits in retirement can make all the difference.

Start with small, actionable steps:

Develop a spending plan: Map out what you can safely withdraw from your savings each month, factoring in your essential expenses, healthcare costs, and discretionary spending.

Track your spending: Monitoring where your money goes can help you identify areas where you may need to cut back.

Mindful spending: Focus on spending intentionally rather than impulsively, considering what truly brings you value in retirement.

Making these adjustments early can set the tone for how you’ll manage your finances moving forward, ensuring that your retirement funds last as long as you do.

3. Early Retirement Warning Signs: Are You Really Ready?

While retiring early may sound like a dream come true, it’s not always the best move—especially if bad spending habits have followed you into retirement. Retiring before you’re financially or psychologically prepared can put you at serious risk of outliving your savings.

Here are a few warning signs that you may not be ready for retirement just yet:

You don’t have a clear budget or spending plan. If you’re not used to tracking expenses or living within a set budget, you may need more time to adjust your spending habits.

You rely on debt or frequently overspend. Carrying debt into retirement can be a major red flag, especially if your spending exceeds your income or withdrawal rate.

You haven’t accounted for healthcare costs. Medical expenses tend to rise as we age, and without a clear plan for healthcare spending, you could deplete your retirement savings faster than expected.

If any of these warning signs resonate with you, it might be wise to reassess your retirement timeline. Taking the time to address spending issues now could save you from financial stress down the road.